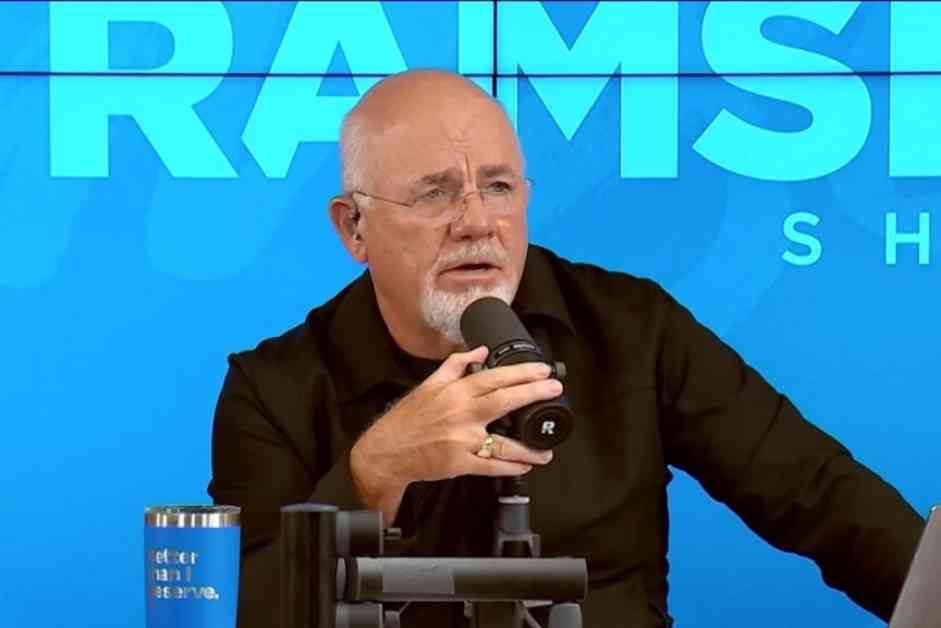

Dave Ramsey is well-known for his strong stance against car payments, emphasizing that they can keep individuals broke due to the rapid depreciation of vehicles. He frequently discusses this topic on various platforms such as TikTok, books, and his radio show, stressing that car payments are often the largest monthly expense for many people.

In one of his TikTok videos, Ramsey boldly states that staying in car payments can lead to a lifetime of financial struggles because vehicles lose their value quickly. He points out that cars can depreciate by up to 60% in the first five years of ownership. To further illustrate his point, Ramsey highlights that the average car payment in the U.S. is $507 per month for 84 months, emphasizing the potential growth of that money if invested wisely instead.

Drawing from his interviews with millionaires, Ramsey notes that a significant percentage of millionaires have not had a car payment in many years. These wealthy individuals often opt for paid-off cars that are typically four years old with moderate mileage. Ramsey suggests that by avoiding car loans and purchasing used cars outright, individuals can invest the money they save, ultimately building wealth over time.

While Ramsey’s perspective on car payments is compelling, it may not be practical for everyone. For many individuals, especially those living in areas with limited public transportation or those who require a vehicle for work, owning a car is a necessity rather than a luxury. In such cases, the focus shifts to managing car payments wisely within one’s financial framework.

Financial experts recommend that transportation costs, including car payments, insurance, and fuel, should ideally not exceed 10% of one’s monthly income. By adhering to this guideline, individuals can strike a balance between owning a reliable vehicle and working towards their financial objectives. While cars do depreciate rapidly, some situations may warrant financing a vehicle with a low-interest rate to avoid depleting savings.

Despite Ramsey’s strong stance on car payments, it is essential to recognize that individual circumstances vary. While avoiding car payments may work for some individuals, life often requires flexibility. For some, responsibly managing a car payment can be a practical financial decision, especially if it aligns with their overall financial strategy.

In conclusion, while Dave Ramsey’s advice on car payments and financial freedom resonates with many individuals, it is crucial to consider personal circumstances and financial goals when making decisions about vehicle ownership. Balancing the need for transportation with long-term financial planning can help individuals navigate the complexities of car payments while working towards financial stability.