The U.S. is known for being a wealthy country, but there are some great investment opportunities in emerging markets, especially in regions like Latin America. One company that stands out in this area is Nu Holdings (NYSE: NU), a digital bank that is experiencing rapid growth and has huge potential for investors. What’s even better is that the stock is currently priced at just $15, making it accessible to a wide range of investors.

Latin America is a vast region with a population of about 656 million people, many of whom do not have access to modern banking services. Nu Holdings is a major player in the financial sector in Latin America, serving over 100 million customers in countries like Brazil, Mexico, and Colombia. The company has seen significant growth in its customer base, with numbers quadrupling in just over four years.

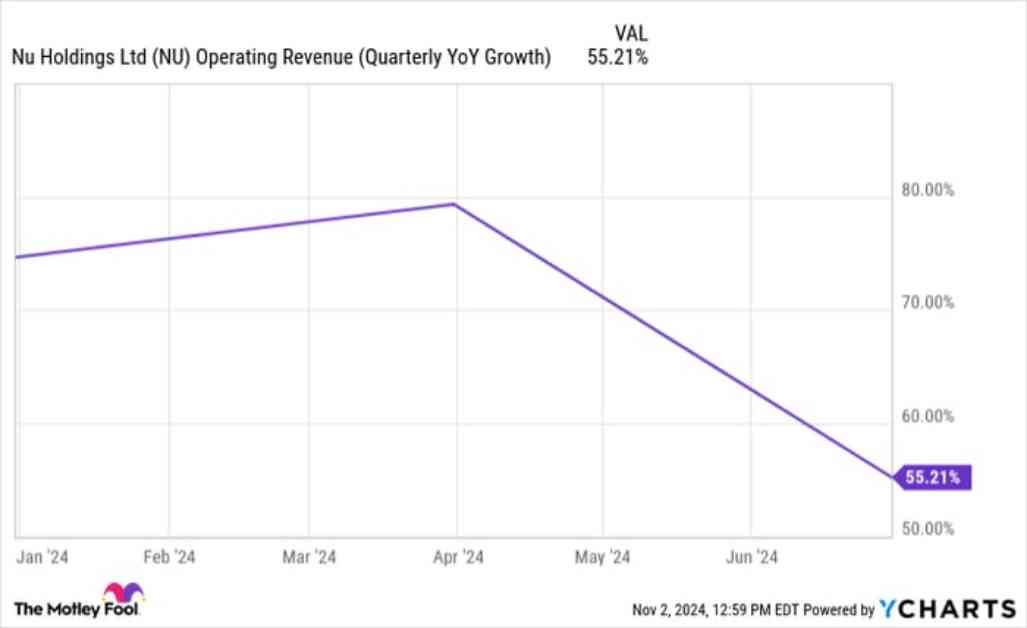

Nu Holdings offers a range of financial services, including banking, credit cards, loans, investing tools, and insurance. The company’s revenue growth has been robust, driven by an increase in the number of customers and the use of multiple products by each customer. In the second quarter of this year, Nu’s non-GAAP income saw a 135% increase compared to the previous year.

Despite the stock’s 70% rise in the past year, analysts believe there is still room for growth. Nu Holdings has a forward P/E ratio of 24 and a low PEG ratio of 0.65, indicating that the stock is still undervalued considering its high earnings growth potential. This makes it a compelling opportunity for investors looking for a bargain in the current market environment.

If you’ve ever felt like you missed out on investing in successful stocks, now might be the perfect time to consider Nu Holdings. The company is poised for continued growth, and its stock presents a great opportunity for investors to capitalize on this potential. Keep an eye on Nu Holdings as it continues to make waves in the financial sector and offers investors a chance to benefit from its success.