How Energy Sector Merger Mania is Driving Higher Prices and How Investors Can Profit

We have witnessed a surge in merger activity in the energy sector recently. One notable deal is ConocoPhillips’ acquisition of Marathon Oil Corp. for $22.5 billion in an all-stock transaction. This move by ConocoPhillips, which has significant domestic assets, could be a strategic move in anticipation of a potential Trump election victory.

This acquisition is part of a trend in the energy industry, with major players like Exxon Mobil Corporation and Hess Corporation also making significant acquisitions. Exxon Mobil recently closed a $59.5 billion deal to acquire Pioneer Natural Resources, making it the largest player in Texas’ Permian Basin. Additionally, Hess Corporation shareholders have approved Chevron Corporation’s $53 billion buyout offer, giving Chevron exposure to oilfields in Guyana.

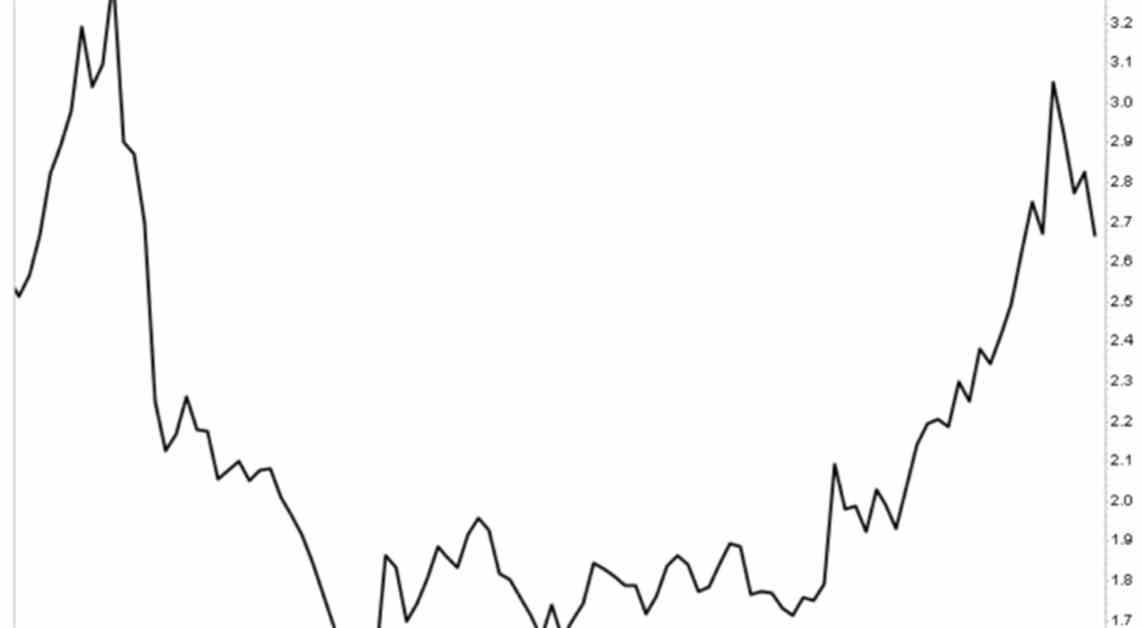

While these mergers dominate the headlines, there is a key factor that investors may be overlooking in the energy sector this summer – the rise in oil prices. Two main factors are expected to drive oil prices higher in the coming months.

Firstly, the summer season is synonymous with increased travel, and as more Americans hit the roads and skies for vacations, the demand for oil is set to rise. Organizations like OPEC are anticipating a surge in crude oil demand in the second and third quarters of this year, driven by increased travel activity.

Secondly, the ongoing conflict between Russia and Ukraine is another significant factor affecting energy prices. The escalating tensions between the two countries could have a substantial impact on oil prices, especially if the conflict intensifies further.

Given these factors, investors can capitalize on the expected rise in energy prices by investing in fundamentally strong energy-related stocks. Energy stocks tend to perform well during periods of increased demand, making them a favorable option for investors looking to hedge against rising energy prices.

In conclusion, with energy prices on the rise due to seasonal demand and geopolitical uncertainties, having exposure to energy stocks can be a profitable strategy for investors. Consider exploring opportunities in the energy sector to leverage the potential growth in this market.

—

**Biography:**

[Include detailed biography of Louis Navellier here]