European markets closed lower on Thursday as fresh U.S. inflation data came in above expectations, impacting investor sentiment. The pan-European Stoxx 600 ended the day 0.18% lower, with most sectors and major bourses in negative territory. Insurance stocks saw a 1.06% increase due to Hurricane Milton’s impact on Florida, while tech stocks fell by 1%. British drugmaker GSK saw a 3.2% increase after settling a U.S. lawsuit over its heartburn treatment Zantac for up to $2.2 billion.

In Germany, the government forecasted the country’s first two-year recession in nearly two decades, signaling economic challenges ahead. The U.S. reported a rise in inflation for September, with a 0.2% increase over the month, surprising economists. The annual inflation rate stood at 2.4%, slightly higher than expected. This data will influence the Federal Reserve’s decision-making at its November meeting, with a potential 70% likelihood of a quarter-point cut in interest rates.

U.S. stocks opened lower on Thursday, with the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average all declining. In the Asia-Pacific region, markets mostly traded higher, buoyed by gains on Wall Street the day before. The S&P 500 and Dow Jones reached new records following the Fed’s September meeting, where a 50 basis points rate cut was implemented.

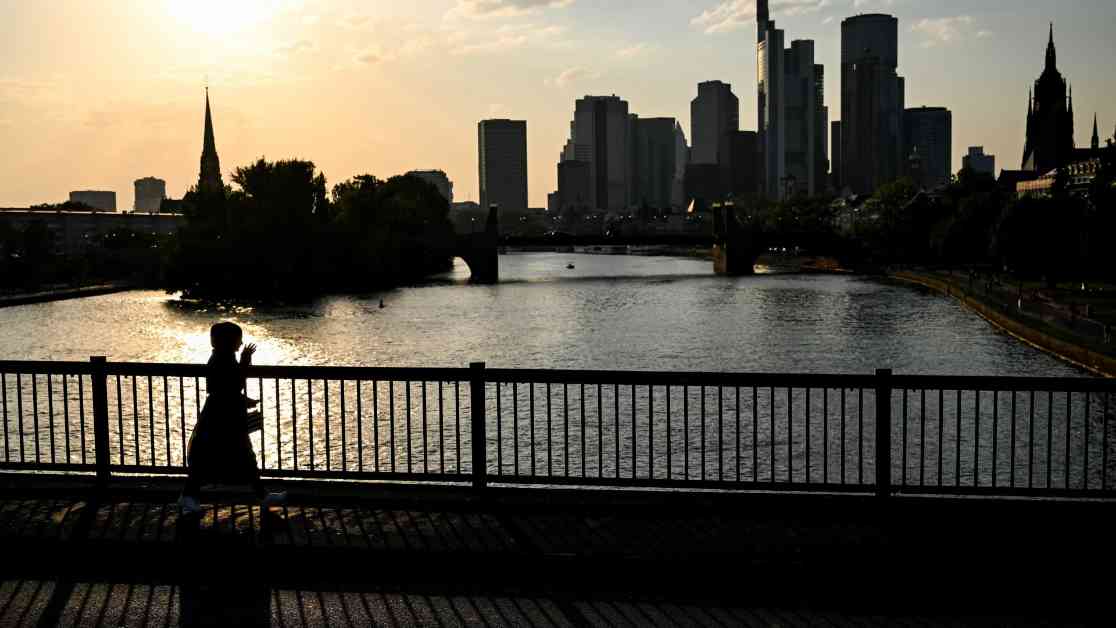

On the European front, markets closed with the Stoxx 600 down 0.18%, continuing a week of choppy trade. Germany’s DAX and France’s CAC 40 both saw declines of around 0.23%, while the U.K.’s FTSE 100 dropped by 0.07%. The British pound weakened against the U.S. dollar, hitting a one-month low due to shifts in central bank communications and economic growth expectations.

Mercedes-Benz reported a slight drop in third-quarter car sales, particularly in Asia, leading to a 0.35% decline in its shares. Meanwhile, Airbus delivered 50 aircraft in September, down from 55 the previous year, amid ongoing production challenges and supply chain shortages in the aviation industry.

Overall, European markets faced challenges from U.S. inflation data, economic forecasts, and company-specific news, impacting investor confidence and market performance. The global economic landscape remains uncertain, with various factors influencing market movements and investor decisions.