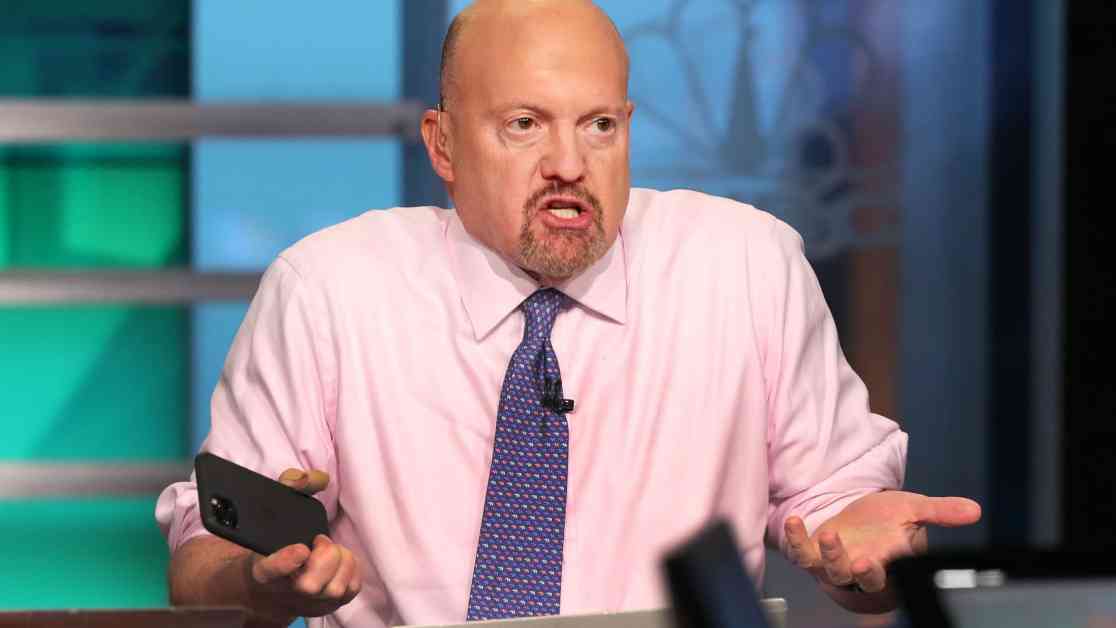

CNBC’s Jim Cramer recently shared his concerns about the current state of the market, warning investors about signs of “excess” that he sees in various sectors. He advised investors to be cautious and not get too greedy, especially if they have seen significant gains in a short period of time.

Cramer highlighted the soaring stock prices following the “Republican sweep” on election day, attributing the rise to expectations of deregulation and lower taxes. However, he pointed out that many of the stocks experiencing dramatic gains are not well-known or part of the usual top performers.

In his analysis, Cramer reviewed 66 stocks that have seen returns of over 50% in the month of November, emphasizing that not all of these gains are sustainable or legitimate. He mentioned various sectors that have seen significant growth, including tech, artificial intelligence, fintech, space, and alternative energy.

Additionally, Cramer discussed the concept of “Trump trades,” referring to stocks that have been favored by Wall Street in anticipation of policies under President-elect Donald Trump’s administration. He specifically mentioned private prison operators and oil service companies as examples of these trades.

While Cramer advised investors to be cautious and consider taking profits on their positions, he did not recommend selling off entire holdings in hot stocks. He emphasized the importance of recognizing when gains may not be sustainable and avoiding the risk of losses.

Overall, Cramer’s message was clear: be grateful for gains, but also be mindful of market conditions and the potential for trends to shift. By staying informed and making strategic decisions, investors can navigate market excess and protect their investments in the long run.