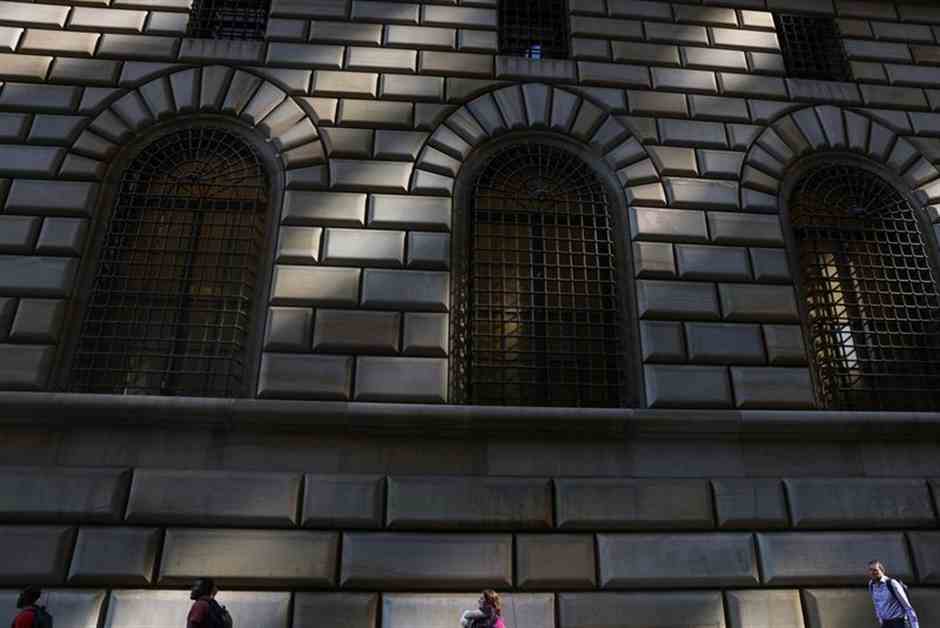

NY Fed Official Urges Market Participants to Prepare for Central Clearing Rules in Treasury Bond Market

A senior official from the Federal Reserve Bank of New York has issued a warning to market participants, urging them to get ready for new clearing rules that are set to be implemented in the Treasury bond market. Michelle Neal, who leads the New York Fed’s Markets Group, emphasized the importance of preparing for the upcoming changes mandated by the Securities and Exchange Commission.

According to Neal, the new SEC rule requires central clearing in the government bond market, with Treasury cash clearing expected to take effect by the end of 2025, and repo clearing by June 30, 2026. She highlighted the significance of these market structure changes and urged businesses to start planning for the transition now.

In a speech delivered at the ISDA/SIFMA Treasury Forum in New York, Neal emphasized that the implementation of a central clearing system will have a significant impact on the markets. She predicted a migration of Treasury repo and reverse repo transactions into central clearing, as well as a shift towards central clearing for principal trading firm electronic cash trading.

Furthermore, Neal pointed out the transparency benefits that the new regime will bring, stating that increased trades through central clearing platforms will enhance visibility into clearing and settlement flows. This, in turn, will lead to improved market monitoring for the official sector.

Market participants are advised to engage in preparations and identify how the SEC rule will affect their businesses in order to adapt to the upcoming changes in the Treasury bond market.

(Reporting by Michael S. Derby; Editing by Chizu Nomiyama)