TJX Cos, the parent company of TJ Maxx, Marshalls, and HomeGoods, is making waves in the stock market after reporting strong earnings and raising its full-year outlook. The company’s third-quarter earnings beat expectations, with a 11% increase in earnings per share and a 6% increase in net sales.

Consolidated comparable sales for the quarter rose 3%, driven by customer transactions and the appeal of the company’s value-driven shopping experience. CEO Ernie Herrman highlighted the wide range of customers attracted to their treasure-hunt shopping concept.

Following the earnings report, several analysts raised their price targets on TJX stock, citing the company’s strong performance and execution. Despite falling short of analyst expectations for full-year earnings, TJX remains optimistic about its growth prospects.

In addition to TJX, other retailers like Bath & Body Works, Macy’s, Burlington, and Kohl’s are reporting their earnings this week. Bath & Body Works saw a significant increase in stock price after beating earnings estimates, while Macy’s faced a decline following an internal investigation into hidden delivery expenses.

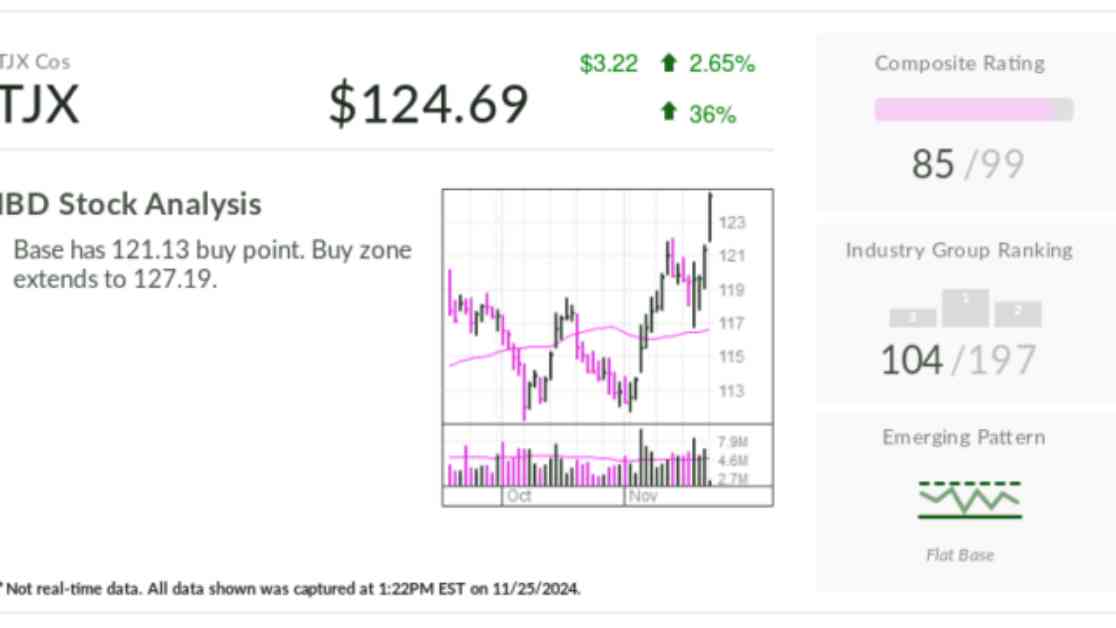

TJX stock is currently trading in a buy zone, with a 32% increase in stock price year-to-date. The stock has been on an upward trend and is trading at record highs.

Investors are closely watching retail earnings reports as the holiday shopping season kicks off. With strong performance from TJX and other retailers, the market is anticipating a busy and profitable season ahead.

As the stock market continues to be volatile, following expert analysis and keeping an eye on emerging patterns can help investors make informed decisions. Stay tuned for more updates on TJX and other market movers.