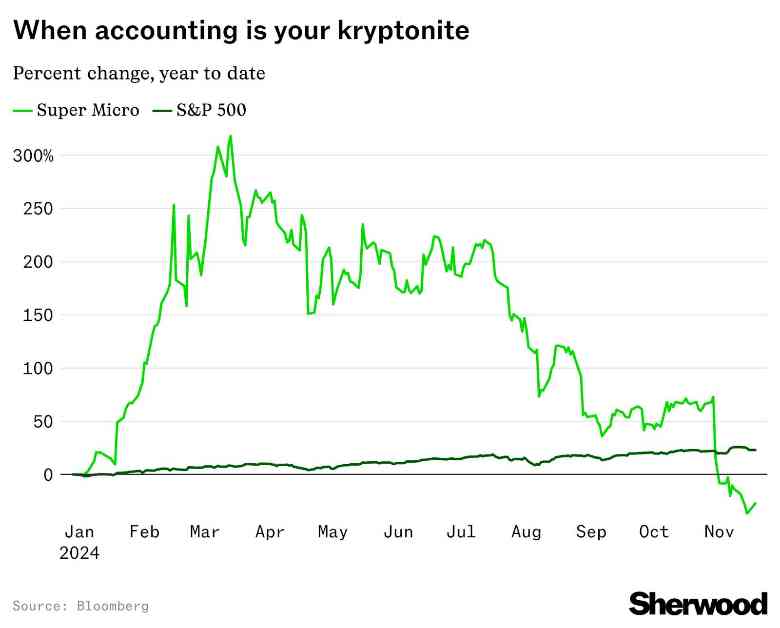

Super Micro stock experienced a significant surge on Monday as the company revealed plans to ensure its continued listing on the Nasdaq exchange. This news comes after Nasdaq sent a letter to Super Micro Computer management in mid-September, giving them 60 days to submit their annual report or offer a plan for compliance with the exchange’s rules. Today marks the 62nd day since that letter was sent, making it the real deadline for the company. Despite the stock’s year-to-date increase of over 300% in mid-March, it is currently down over 25% for the year.

In other market news, stock market exposure saw a substantial increase following President-elect Donald Trump’s victory, with Deutsche Bank reporting the biggest weekly jump in equity positioning on record. Discretionary investors’ positioning is at its 96th percentile, while exposure by systematic strategies remains moderate relative to historical data. Cyclicals, particularly financials, have been the primary beneficiaries of the heightened interest in US stocks since the election.

On the flip side, Palantir, one of the top-performing stocks this year with a gain of over 280%, is facing its worst day in months. The sudden selloff appears to be driven by concerns about the rapid and substantial increase in share price, leading some investors to take profits. Despite key valuation metrics like a forward PE multiple above 130 and a price-to-sales multiple of around 57, which are among the highest in the S&P 500, there is speculation about Palantir potentially becoming a tech giant comparable to Meta, Apple, and Amazon.

The current market dynamics reflect the ongoing volatility and uncertainty in the financial landscape, with companies like Super Micro and Palantir navigating challenges and opportunities in the ever-changing stock market environment. Investors will closely monitor developments in these and other companies to assess potential risks and rewards in their investment portfolios.