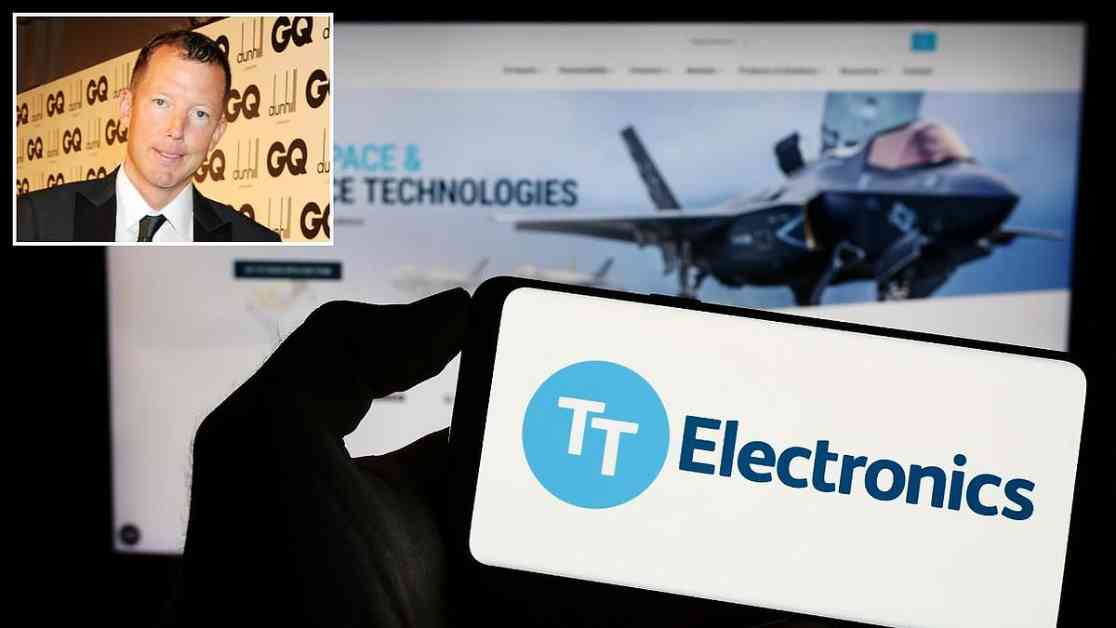

Small-cap components manufacturer TT Electronics saw a significant increase in its stock value after Volex, a rival company, made two takeover offers. However, TT’s board declined to engage in discussions and rejected the bids made by Volex. The initial bid included cash and paper, valuing TT’s shares at 129p each. Volex followed up with a second offer, valuing TT’s shares at 135.5p each, totaling around £249 million compared to TT’s current market value of £140 million. Volex, on the other hand, is valued at £623 million. Nat Rothschild, the executive chair of Volex, stated that merging the two companies would establish a leading presence in the specialist electronics market.

TT Electronics confirmed that it had turned down Volex’s takeover offer, as well as a higher bid from an undisclosed third party. The company believed that the offers undervalued its potential and long-term prospects. This decision came shortly after TT’s disappointing trading update, which included a reduction in full-year profit guidance and the announcement of the upcoming retirement of their chief financial officer, Mark Hoad, in September.

In contrast, Volex reported improved half-year results, with a 21% increase in pre-tax profit and a 30% rise in revenue. The company remains on track to meet its full-year expectations for the current financial year. Following the takeover bids, TT’s shares surged by 40.5% while Volex’s shares declined by 10.7%.

Amidst the news of the takeover bids, the UK stock market showed caution in response to a slowdown in third-quarter growth. The FTSE 100 edged up by 0.1%, while the FTSE 250 dropped by 0.2%. Analysts at Barclays revised their sector preferences following the Budget and US elections, leading to mixed results for hotel operators InterContinental Hotels and Whitbread. InterContinental Hotels saw a slight increase, while Whitbread experienced a decline.

In other market news, Solid State faced a significant drop in its stock value after announcing a pause in payments related to a government defence contract pending a strategic defence review. However, the company remains optimistic about receiving orders in the future. On a positive note, Angle saw a 15% increase in its stock value after presenting new data at a cancer research conference, highlighting advancements in cancer diagnostics.