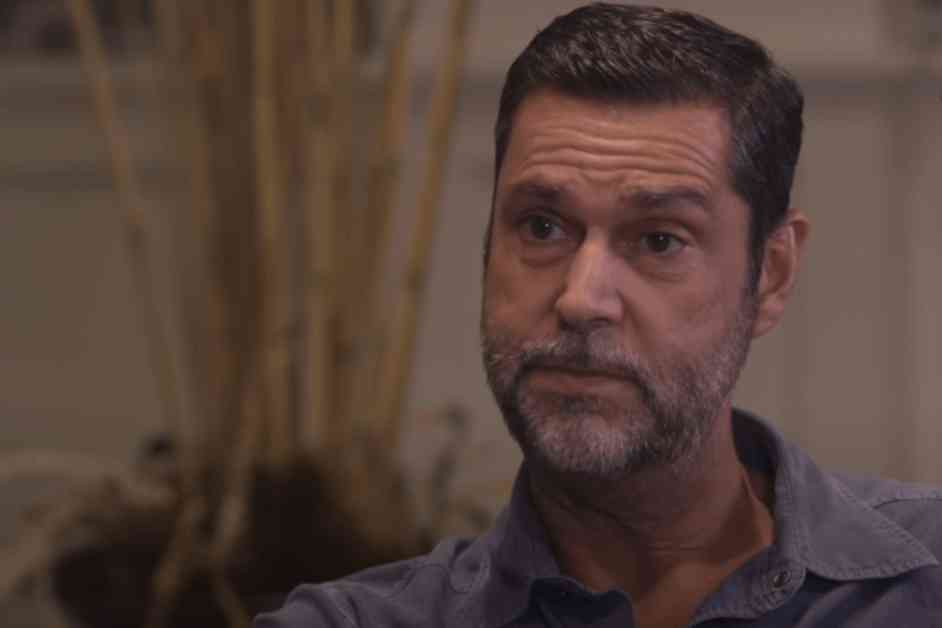

Raoul Pal, the CEO and co-founder of Real Vision and Global Macro Investor, recently shared his insights on the current state of the markets in a Wealthion podcast episode with Anthony Scaramucci. Pal’s views on recession fears, market volatility, and investment opportunities shed light on the evolving landscape for investors.

Market Volatility: A Gift for Investors

Pal delved into the topic of market volatility, particularly in the crypto markets, highlighting the inherent nature of fluctuations in this asset class. While drawdowns of 30% or more are not uncommon historically, Pal views these periods of turbulence as opportunities rather than threats. He referred to these downturns as “macro spasms,” short-lived episodes that present investors with the chance to enter the market at lower prices, ultimately boosting long-term returns.

Emphasizing that the business cycle is still in its early recovery phase, Pal noted that inflation is cooling, interest rates are poised to drop, and liquidity is set to increase. This favorable environment for risk assets, including crypto, aligns with Pal’s strategy of viewing sell-offs as opportunities to enhance returns over time by capitalizing on lower prices.

The Yen Carry Trade and Macro Spasms

The conversation shifted to the yen carry trade and its broader implications on market sell-offs. Pal explained how movements in the yen can trigger market disruptions, especially when risk managers at financial institutions reduce exposure in response to yen appreciation. Drawing parallels to events in 2016, Pal highlighted the differences in the current environment, with the business cycle showing signs of an upturn and central banks, particularly in China, likely to stimulate their economies further, benefiting the markets.

The Central Bank’s Money Printer: A Market Safety Net

Pal also discussed the pivotal role of central banks in supporting markets through monetary stimulus, often referred to as “money printing.” While this intervention has led to currency debasement and erosion of purchasing power since the global financial crisis in 2008, Pal noted that it has significantly reduced the likelihood of a major market crash. The safety net created by central banks has lowered the probability of a 50% market downturn compared to previous decades, primarily due to their willingness to intervene.

The Distinct Roles of Bitcoin, Ethereum, and Solana in the Blockchain Ecosystem

Pal elaborated on the unique roles that Bitcoin, Ethereum, and Solana play within the blockchain ecosystem, likening them to decentralized businesses offering different attributes for various use cases. Bitcoin’s unparalleled security positions it as a store of value, while Ethereum serves as the backbone of the finance industry in the crypto space, with strong security, wide adoption, and continuous innovation supporting its role in decentralized finance (DeFi) and high-value transactions.

Solana, according to Pal, has emerged as a standout performer in the current market cycle, gaining traction due to its speed, user-friendly applications, and cost-effectiveness. While Pal does not foresee Solana surpassing Ethereum, he believes it is closing the gap significantly. Solana’s rapid growth and innovation make it well-suited for retail and fast-moving applications, with resolved challenges solidifying its position in the blockchain hierarchy.

Pal’s price predictions for Solana are bullish, ranging from $800 in a worst-case scenario to $2,500 in a blowoff top. He envisions Solana potentially reaching $1,000 or more by the end of the market cycle, underscoring his confidence in its growth and adoption trajectory.

Spot Crypto ETFs and the Rising Demand for Digital Assets

The conversation extended to the growing popularity of spot crypto ETFs, despite recent market volatility. Net inflows into crypto ETFs signify increased adoption and acceptance among traditional investors, attributed to a broader understanding of crypto’s role as a hedge against currency debasement and inflation. The volumes in ETFs, driven by net inflows and arbitrage opportunities, reflect the market’s sophistication, with education efforts by industry leaders aiding investors in navigating the asset class’s volatility and opportunities.

The Future of Blockchain and NFTs

Pal’s optimism about the future of blockchain technology shines through his prediction of the crypto space expanding from a $2 trillion market cap to $100 trillion by 2032. This growth, driven by the elimination of third parties in transactions and resulting cost savings, represents a significant accumulation of wealth, setting the stage for transformational changes in wealth distribution.

Defending the long-term value of NFTs, Pal highlighted their potential beyond digital art and collectibles, envisioning their use in global ticketing, digital IDs, property deeds, and derivative contracts. NFTs, by creating digital scarcity, play a crucial role in preserving value in a digital world where assets tend to depreciate over time.

Political Implications and the Role of Government in Crypto

Pal and Scaramucci explored the potential impact of government policies on the crypto market, including discussions about a national Bitcoin stockpile proposal and the upcoming U.S. presidential election’s implications. While uncertainties loom regarding the new Democratic ticket’s approach to crypto regulation, the industry’s growing influence, with 50 million Americans owning crypto, underscores the importance of navigating evolving government dynamics.

In conclusion, Pal’s insights offer a comprehensive overview of the current market landscape, highlighting potential opportunities and risks for investors in the ever-evolving crypto and blockchain space. As the industry continues to mature and adapt to changing dynamics, staying informed and strategic in investment decisions remains paramount for navigating the complexities of the digital asset landscape.