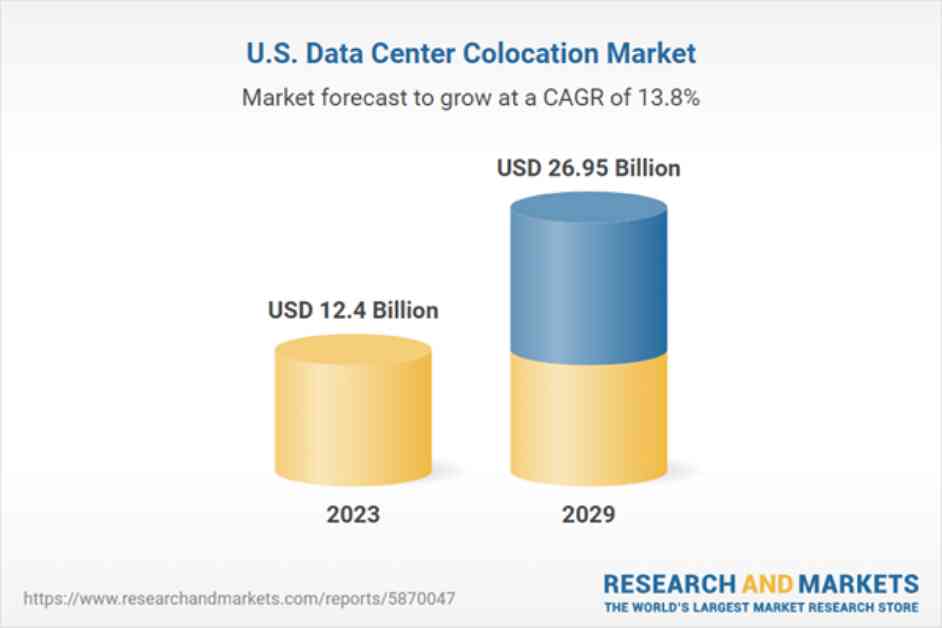

The U.S. data center colocation market is poised for significant growth, with a forecasted value of $26.95 billion by 2029. Despite its potential, the market faces challenges such as supply chain disruptions, inflation, workforce shortages, and power constraints. This limits new entrants, particularly in core submarkets where land and power availability are scarce. However, emerging submarkets like Aurora and Elk Grove Village are gaining traction as viable alternatives.

The United States is known for having one of the most expensive regions for developing data center facilities, with costs averaging between $10 to $11 million per MW. The market is expected to see an annual increase of 5-7%, with Texas standing out as a highly competitive market due to active development by numerous colocation operators.

In terms of opportunities and trends, the advent of the sixth-generation (6G) networks is set to revolutionize the industry by bringing advanced networking technologies that will facilitate the implementation of the Industrial Internet of Things (IIoT). Sustainability initiatives are also on the rise among colocation operators, with a focus on renewable energy sources to reduce carbon emissions. Artificial intelligence (AI) and virtual reality (VR) are driving market growth, with businesses increasingly seeking reliable hosting solutions for their AI and VR applications.

Key players in the market include Equinix, Digital Realty, Aligned Data Centers, CyrusOne, QTS Realty Trust, NTT DATA, and others. Geographically, data center operators are focusing on regions like the Southeastern U.S., the Midwest, the Western U.S., and key locations such as Phoenix, Arizona, and Northern Virginia.

The vendor landscape is expected to see both wholesale and retail colocation vendors thriving due to increased demand from sectors like BFSI, IT, telecom, and cloud. Major global operators like Equinix, Digital Realty, and CyrusOne are present in the market, alongside new players like Tract, Corscale Data Centers, and Crane Data Centers. The competition is expected to intensify, providing clients with a variety of colocation service options.

In conclusion, the U.S. data center colocation market is poised for substantial growth, driven by technological advancements, sustainability initiatives, and increased demand for AI and VR applications. With a diverse vendor landscape and a focus on geographical expansion, the market is set to offer innovative solutions to meet the evolving needs of businesses across various industries.