The Forex market is one of the most lucrative financial markets in the world, which requires brave, daring, and successful personalities. This market has gained a lot of attention from users due to its various services, speed of operation, and the use of technology for liquidity and analysis of different prices.

Iranians have also become interested in this market’s growth and need to join a Forex exchange to participate in it. However, since Forex trading involves foreign currencies, most Forex exchanges face financial issues. By reading the following information, you can become familiar with ways to participate in the Forex market.

1. Payment

To pay a Forex exchange, you can use the cryptocurrency payment method. First, you need to find the Forex exchange that you want, then convert the desired amount into digital currency based on the currency’s market price, and deposit it into your account in the Forex exchange.

2. Profit withdrawal

To withdraw profits from the Forex exchange, you can directly deposit it into your bank account in Iran. In this step, you need to wait for the period specified by the Forex exchange until the withdrawn amount is deposited into your account.

3. Paying taxes

To pay taxes as an Iranian Forex trader, you should consider the current regulations in the country and go to the relevant tax offices and pay your taxes.

4. Choosing a reliable Forex broker

To choose a reliable Forex broker for Iranians, you should consider the following:

- You should pay attention to the credibility and regulations of the Forex exchange and use well-known and supervised exchanges.

- Most reliable Forex exchanges are located outside of Iran.

- The importance of technical and scientific analysis in the Forex market should not be forgotten.

- You should check if the Forex exchange complies with KYC and AML regulations or not.

- You should make sure that the exchange properly supports its users.

Therefore, the best way to start Forex trading is to analyze the market, receive new viewpoints, and listen to customer assistance from the Forex exchange. Given the financial transactions in the Forex market, having a reliable Forex exchange is essential for Forex traders.

What documents do Iranians need to pass the KYC at a Forex broker?

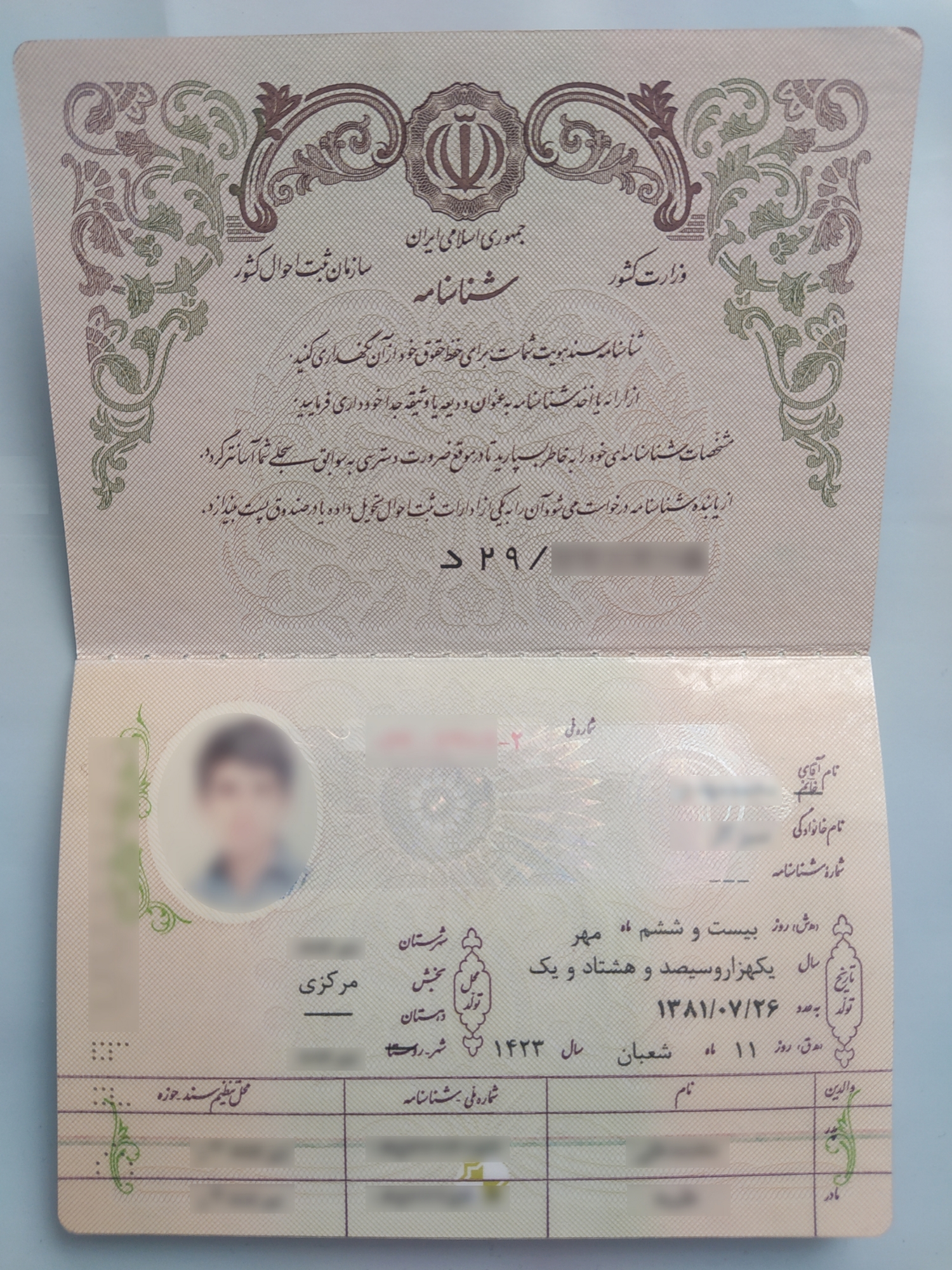

To participate in Forex trading as an Iranian, you need to go through the KYC process (know your customer) with a Forex broker. This process is a legal requirement that ensures the safety and security of your account and the exchange. The KYC process requires you to provide some documents to verify your identity and other personal information.

The following are some of the main documents that Iranians need to pass the KYC process at a Forex broker:

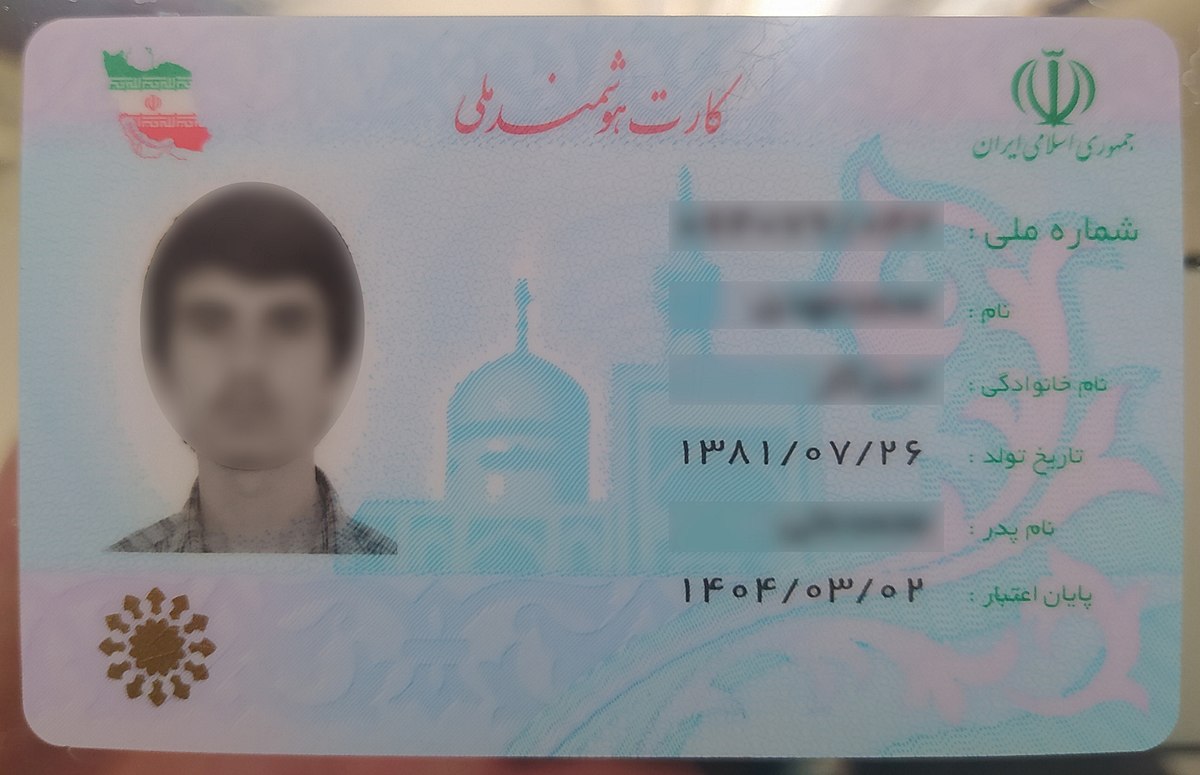

1. National ID Card

Your national ID card is one of the primary documents that you need to provide to pass the KYC process. This card contains important information about your identity, including your full name, date of birth, and unique identification number.

2. Passport

If you have a passport, it is also an acceptable document to verify your identity during the KYC process. A passport contains essential information about your identity, including your full name, date of birth, nationality, and passport number.

3. Proof of Address

You will also need to provide proof of your address to complete the KYC process. This can be done by providing a recent utility bill, bank statement, or official government letter that shows your name and address.

4. Bank Statement

You may need to provide a bank statement showing your transaction history, account balance, and personal information to pass the KYC process. This document is also used to verify your payment methods and bank details.

5. Tax Identification Number

A tax identification number (TIN) is a unique code issued by the government to identify taxpayers in Iran. Providing your TIN is also required to pass the KYC process.

Overall, these are some of the main documents that Iranians need to pass the KYC process at a Forex broker. It is essential to note that different Forex brokers may have slightly different requirements depending on their policies and regulations. Therefore, before starting the KYC process, you should check the broker’s website or contact their customer support to get accurate and up-to-date information on the required documents.