In a recent interview, geographer Brett Christophers discusses the rise of what he calls an “asset-manager society,” where massive multinational investment firms like Blackrock, Macquarie, and Allianz have expanded into owning essential assets like housing and infrastructure. These assets are ultimately owned by pension funds, insurance companies, and banks through complex asset management schemes, leading to a lack of transparency and understanding about who truly owns these assets.

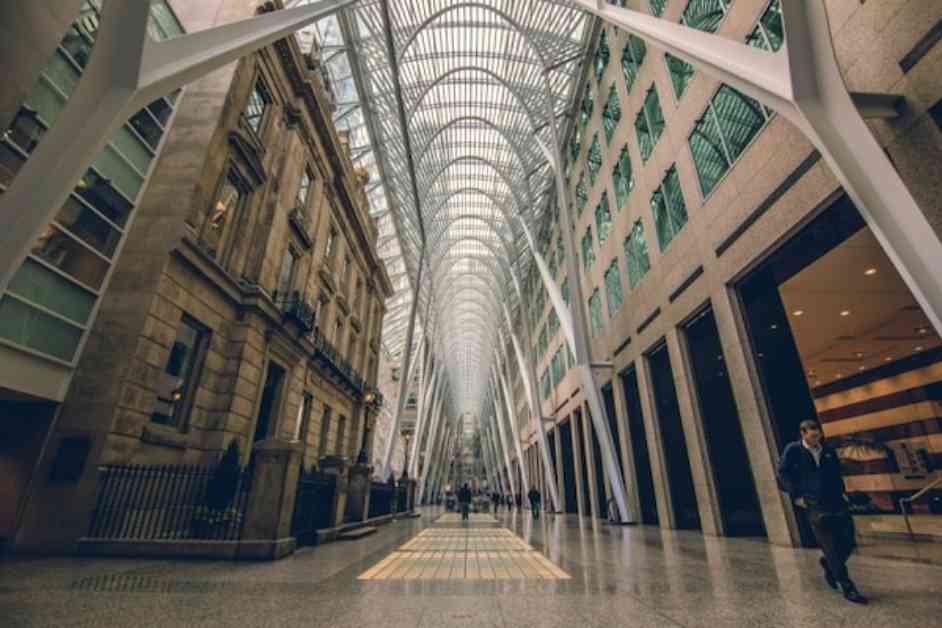

Christophers highlights the influence of Toronto-based asset manager Brookfield, which manages almost $1 trillion in assets across the globe. He also discusses the “Canadian model” of pension funds, where funds like the Canada Pension Plan and the Ontario Teachers’ Pension Plan directly invest in housing and infrastructure, bypassing global asset managers.

When it comes to investment decisions, Christophers explains the difference between open-ended and closed-end funds, noting how closed-end funds have a fixed lifespan, leading asset managers to focus on selling assets for profit within a certain timeframe. He also delves into the appeal of renewable energy assets to firms like Brookfield and the challenges of the current financial environment on investment decisions.

The interview also touches on the “Canadian model” of pension fund activities, where Canadian pension funds invest directly in infrastructure, bypassing asset managers. Christophers discusses the benefits of this model and its potential replication in other parts of the world.

In terms of who truly benefits from the asset-manager society, Christophers argues that the system primarily serves the interests of asset managers and wealthy investors, rather than ordinary workers whose retirement savings may be invested in these funds. He emphasizes the need for transparency and accountability in how these funds are managed and invested.

When it comes to fighting back against the asset-manager society, Christophers suggests engaging with pension fund trustees to ensure investments align with ethical standards and lobbying politicians to regulate the investments of asset managers in critical assets like housing and infrastructure. By understanding the vulnerabilities of asset managers and advocating for responsible investment practices, individuals can push back against the growing influence of these financial giants in society.