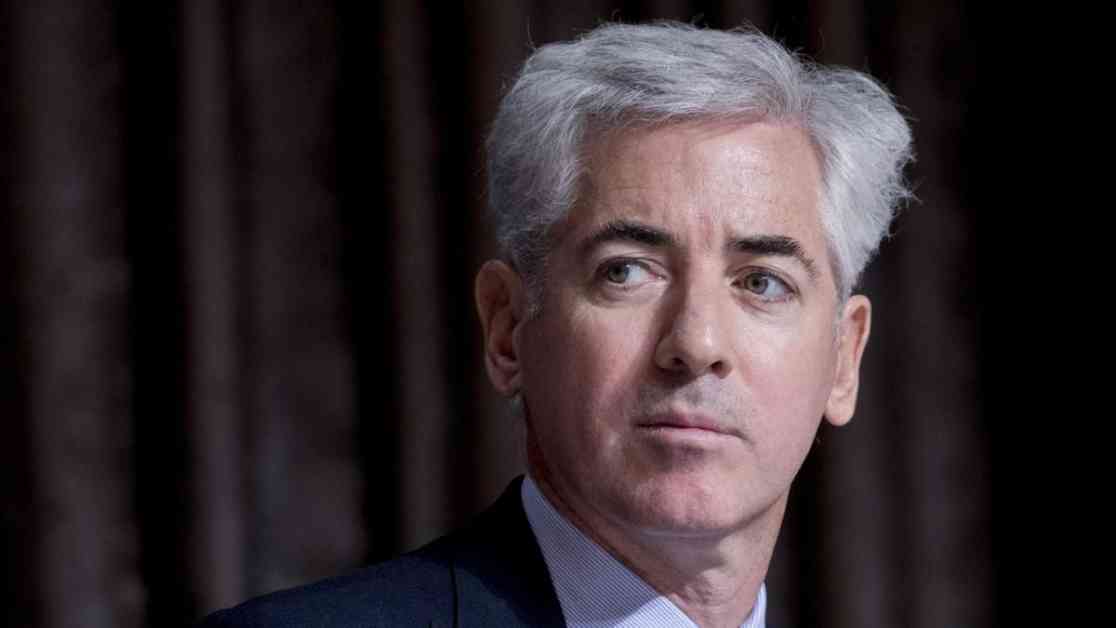

Bill Ackman, a prominent hedge fund manager known for his strategic investments, has been making significant moves through his firm, Pershing Square Capital Management. Ackman is recognized for targeting undervalued companies and advocating for changes to enhance shareholder value. In the third quarter of 2024, Pershing Square made key adjustments to its holdings, focusing on major players like Nike and Brookfield Corporation.

Ackman’s confidence in Nike is evident as Pershing Square substantially increased its stake in the global sportswear giant. This decision aligns with Nike’s recent market performance and strategic initiatives, such as direct-to-consumer sales and sustainability efforts. Additionally, Pershing Square boosted its investments in Brookfield, reflecting Ackman’s interest in the alternative asset management sector.

The SEC Form 13F filing revealed Pershing Square’s strategic shifts, including the reduction of holdings in companies like Hilton Worldwide and Restaurant Brands International. While Pershing Square increased its stake in Nike, it also strategically added Seaport Entertainment to its portfolio, showcasing a willingness to explore opportunities in the entertainment industry.

Despite aggressive acquisitions, Ackman tactically scaled back investments in certain stocks like Hilton Worldwide and Restaurant Brands International due to industry challenges. However, Pershing Square continues to hold significant positions in companies like Chipotle Mexican Grill and Howard Hughes Corporation, emphasizing a diversified portfolio strategy.

Ackman’s outspoken nature and focus on corporate governance have sparked public discussions about financial responsibility. His proactive investment approach in Q3 2024 demonstrates a blend of consolidation and exploration, aiming to capitalize on strong positions while seeking new opportunities for growth. Ackman’s decisions will continue to influence market trends and investor confidence as his investments evolve.

Moving forward, the performance of Pershing Square’s investments amidst market volatility will be closely monitored. Ackman’s strategic vision for identifying transformative companies and navigating industry challenges will shape the firm’s future returns. Investors and analysts will observe how Ackman’s nuanced investment approach unfolds in the coming months, reflecting the dynamic nature of hedge fund management.