Today in the forex market, there are some key events to keep an eye on. In the European session, the Swiss CPI will be the highlight of the day. Over in the American session, we have two major data releases – the US NFP and the ISM Manufacturing PMI.

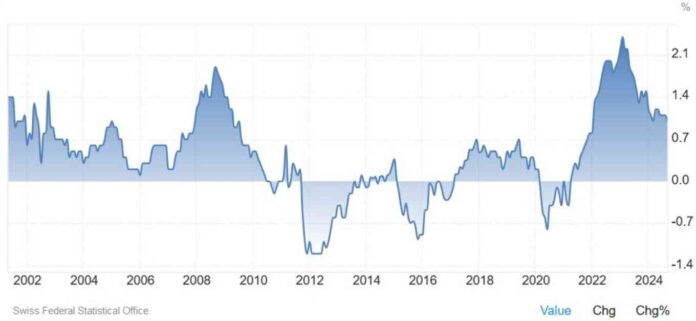

Starting with the Swiss CPI, the year-on-year measure is expected to be at 0.8%, while the month-on-month measure is forecasted to be at 0.0%. Despite inflation in Switzerland staying within the SNB’s target range of 0-2%, it has been steadily decreasing. The market is currently pricing in a 27% chance of a 50 bps cut in December, and a weak CPI report could raise those probabilities to around 50%.

Moving on to the US NFP, it is expected to show 113K jobs added in October, with the Unemployment Rate remaining steady at 4.1%. The Average Hourly Earnings year-on-year is forecasted to be at 4.0%, while the month-on-month measure is expected to be at 0.3%. This report may be tricky due to distortions from hurricanes and strikes in October, but the market’s focus is primarily on the US election.

Lastly, the US ISM Manufacturing PMI is expected to be at 47.6, slightly higher than the previous month. The New Orders index will be crucial to watch as it reflects recent developments. Businesses are still uncertain due to the upcoming US election, which is why the market is closely monitoring these indicators. Keep an eye on the new orders index as it is likely to be the first to react to the recent 50 bps cut from the Fed.