The gold miners are gearing up to report their best quarter ever, with Q3 earnings season on the horizon. This quarter is expected to be fueled by record-high gold prices and lower mining costs, potentially doubling sector unit profits. Despite gold’s significant uptrend over the past year, gold stocks have lagged behind. The lack of interest in gold stocks can be attributed to a variety of factors, including poor sentiment, a strong US Dollar, and the distraction of the AI stock bubble.

However, the fundamentals of gold miners remain strong, with impressive growth in per-ounce profits over the past year. These substantial earnings have driven down price-to-earnings ratios for gold miners, making them undervalued compared to their metal. The upcoming Q3 results are expected to show a significant increase in profitability, with potential for record-breaking earnings.

One key factor contributing to this expected growth is the forecasted lower mining costs for major gold miners in the second half of 2024. Companies like Newmont have provided guidance indicating a decrease in all-in sustaining costs, which could lead to improved profitability. If these forecasts hold true, the sector could see a significant increase in unit earnings, potentially exceeding the previous record set in Q2’24.

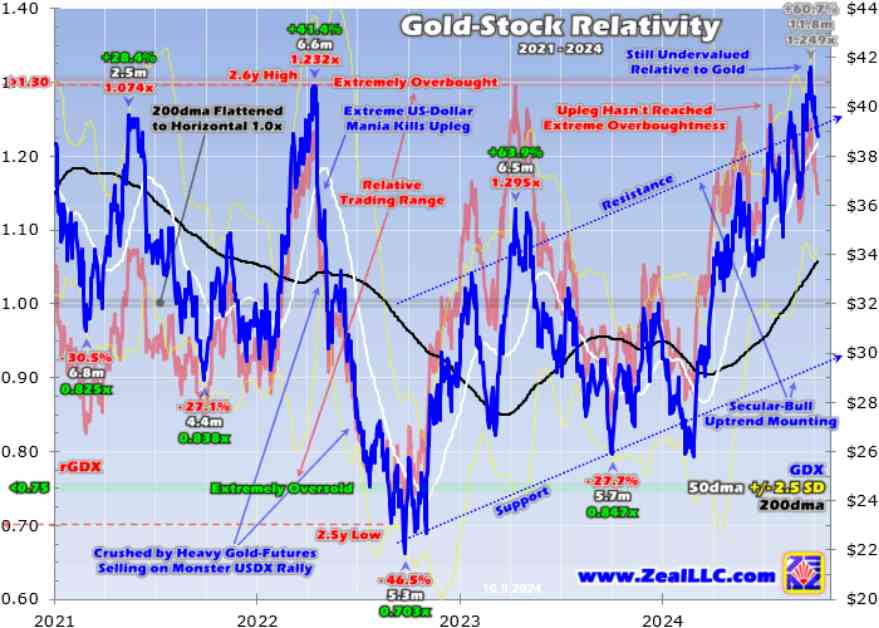

Despite the positive outlook for gold miners, the sector may face some near-term challenges due to the overbought nature of gold prices. Gold stocks typically leverage gold, meaning they may experience downside pressure if gold prices pull back. However, historical data suggests that gold stocks are currently undervalued and may not experience significant downside leverage in the event of a gold selloff.

Overall, the gold mining sector is poised for a strong performance in Q3, driven by record gold prices and lower mining costs. While short-term challenges may arise due to the overbought nature of gold, any resulting selloff in gold stocks could present a buying opportunity for investors. With gold prices continuing to rise, including gold miners in a diversified portfolio could lead to increased returns and reduced overall portfolio risks.